Fraud Response Compliance Risk Mitigation Network 3501017604 3806408190 3509681277 3475335175 3881180016 3533499830

The Fraud Response Compliance Risk Mitigation Network represents a structured approach to addressing the complexities of fraud risk. Its focus on preventative measures and effective response strategies highlights the necessity of robust frameworks. Key components, such as systematic risk assessments and advanced detection tools, are essential for organizations aiming to enhance their resilience. However, the effectiveness of these measures often hinges on collaborative information-sharing practices. This raises critical questions about implementation and adaptability in diverse organizational contexts.

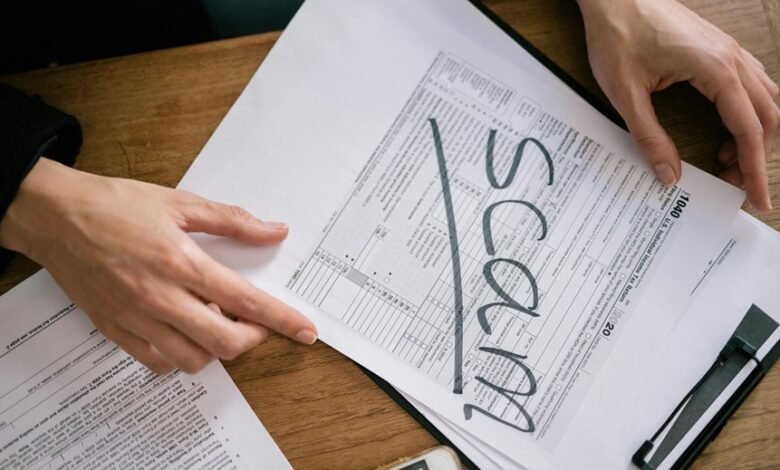

Understanding the Importance of Fraud Response Strategies

Although organizations often prioritize preventative measures, understanding the importance of fraud response strategies is crucial for effective risk management.

Fraud detection alone is insufficient; robust response planning is essential to mitigate damages and restore integrity.

Key Components of the Compliance Risk Mitigation Network

A comprehensive compliance risk mitigation network comprises several critical components that work in tandem to address potential vulnerabilities.

Essential elements include robust compliance frameworks that establish regulatory guidelines and systematic risk assessment processes that identify, analyze, and prioritize risks.

Together, these components enhance organizational agility, ensuring that entities remain vigilant and adaptable in an ever-evolving landscape of compliance and fraud prevention.

Tools and Techniques for Enhancing Fraud Prevention

Effective fraud prevention relies on a combination of advanced tools and techniques that integrate seamlessly into existing compliance risk mitigation frameworks.

Key components include robust fraud detection systems employing machine learning algorithms, which enhance risk assessment capabilities.

Furthermore, real-time monitoring tools and data analytics empower organizations to proactively identify vulnerabilities, thus fostering a resilient environment that prioritizes integrity and transparency in financial transactions.

Collaborative Approaches to Information Sharing and Risk Management

Regularly, organizations that engage in collaborative approaches to information sharing create a more robust framework for managing fraud risk.

Through effective information exchange, entities enhance their risk assessment capabilities, allowing for a comprehensive understanding of potential threats.

This synergy fosters a proactive stance, enabling participants to identify vulnerabilities collectively and implement strategic measures that mitigate risks, ultimately promoting a culture of transparency and security.

Conclusion

In conclusion, the Fraud Response Compliance Risk Mitigation Network serves as a fortified bastion against the ever-evolving landscape of fraud. Just as a seasoned sailor navigates turbulent seas by relying on a well-equipped crew and a sturdy ship, organizations must harness collaborative strategies and advanced tools to weather potential threats. By fostering a culture of transparency and adaptability, they not only safeguard their assets but also ensure sustained integrity, ultimately steering towards a more secure operational future.